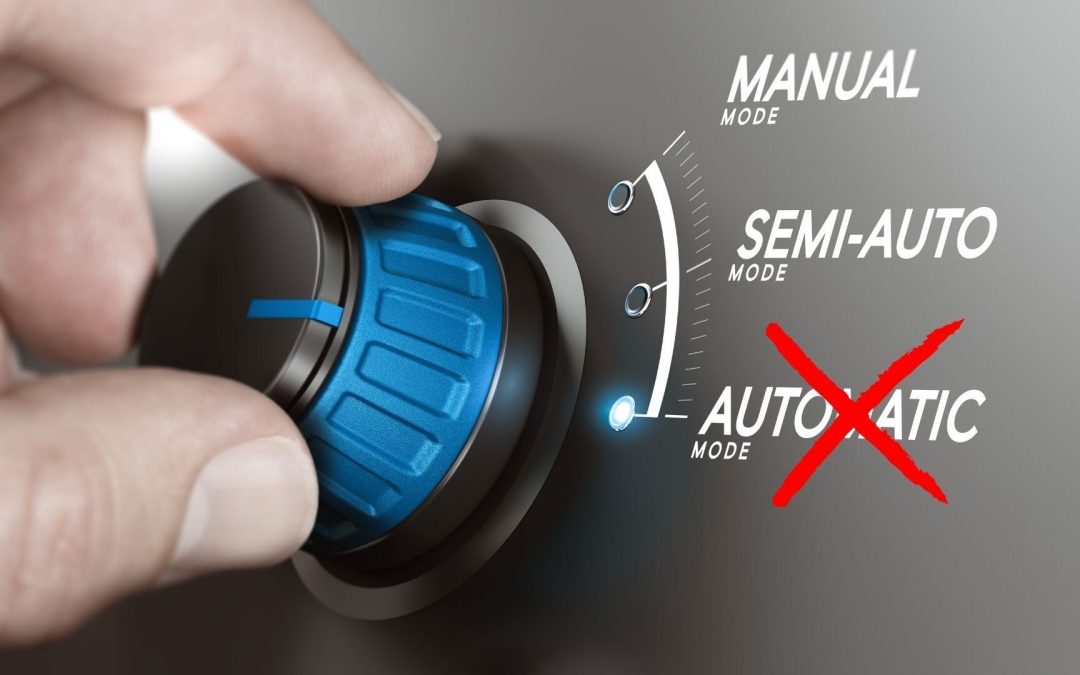

You signed your estate planning documents years ago and filed them away. Done, right? Not quite. Many people believe that once their will or trust is signed, everything will work as intended without any further action. This assumption leads to costly mistakes, unnecessary court involvement, and outcomes that don’t reflect what families actually wanted. Here’s the truth: there is no automatic in estate planning.

Estate planning is not a one-time event. It’s an ongoing process that requires attention, proper implementation, and regular review to remain effective. Documents alone aren’t enough; they must be coordinated with your assets, updated as circumstances change, and aligned with current law.

Why “Automatic” Does Not Exist in Estate Planning

- Documents Do Not Update Themselves. Life circumstances evolve, such as marriages, divorces, births, deaths, changes in residence, or changes in the law, which can significantly alter the effectiveness of an estate plan. A will or trust drafted years ago without review may no longer reflect your wishes or the needs of your family.

- Beneficiary Designations Control Asset Distribution. Retirement accounts, life insurance policies, and payable-on-death accounts pass directly to the beneficiaries named on those accounts, regardless of what your will or trust says. Outdated beneficiary designations are one of the most frequent sources of unintended distributions and can create probate problems requiring court proceedings.

- Trusts Must Be Properly Funded. THIS BEARS REPEATING: Establishing a trust is only the first step. Assets must be correctly titled or transferred into the trust for it to work. Without funding, a trust is essentially an empty document, and your estate may still go through probate.

- Laws Are Subject to Change. Tax laws, probate rules, and state-specific statutes are amended regularly. A plan that was once effective may no longer provide the same protections or advantages under current law.

- Family Dynamics Shift Over Time. Changes in relationships, financial circumstances, or health needs may render an existing plan outdated or even problematic without periodic review.

Estate Planning Requires Active Maintenance

Think of your estate plan as a vehicle; it needs regular maintenance to remain reliable. Effective estate planning involves:

- Regular review and updates (generally every three to five years, or after major life events)

- Coordination of documents with beneficiary designations and account titling

- Ongoing communication with legal, financial, and tax advisors to ensure consistency

Don’t Let Your Estate Plan Gather Dust

Estate planning is not “set it and forget it.” Without deliberate effort, your documents won’t continue to reflect your intentions or protect your loved ones. A comprehensive plan requires active management and periodic review to remain effective.

When you approach estate planning as an ongoing process rather than a one-time transaction, you help ensure that your wishes are carried out, your loved ones are protected, and unnecessary legal complications are avoided.

Schedule Your Estate Planning Review

If you haven’t reviewed your estate plan recently, or if you don’t yet have a plan in place, now is the time to act. At DRS-Law, we help you create, update, and maintain a comprehensive estate plan that reflects your unique goals and circumstances. Contact us today at 805.374.8777 to schedule a consultation and take the next step toward protecting your legacy and providing peace of mind for yourself and those you love.