Decisions Concerning Choice of Successor Trustees / Agents

One of the questions that comes to me most often is “Who to choose as my Successor Trustee?” followed by “Should I choose Co-Trustees?” These, of course, are very important decisions. However, it is important to remember that revocable trust decisions made today may...

Comprehensive Estate Planning: When is a Trust Used?

Estate planning is akin to drafting the script of your legacy’s story. A pivotal chapter in this narrative involves the judicious use of trusts. Here, we’ll uncover the tools behind trusts, their pivotal role in securing one’s legacy and the other...

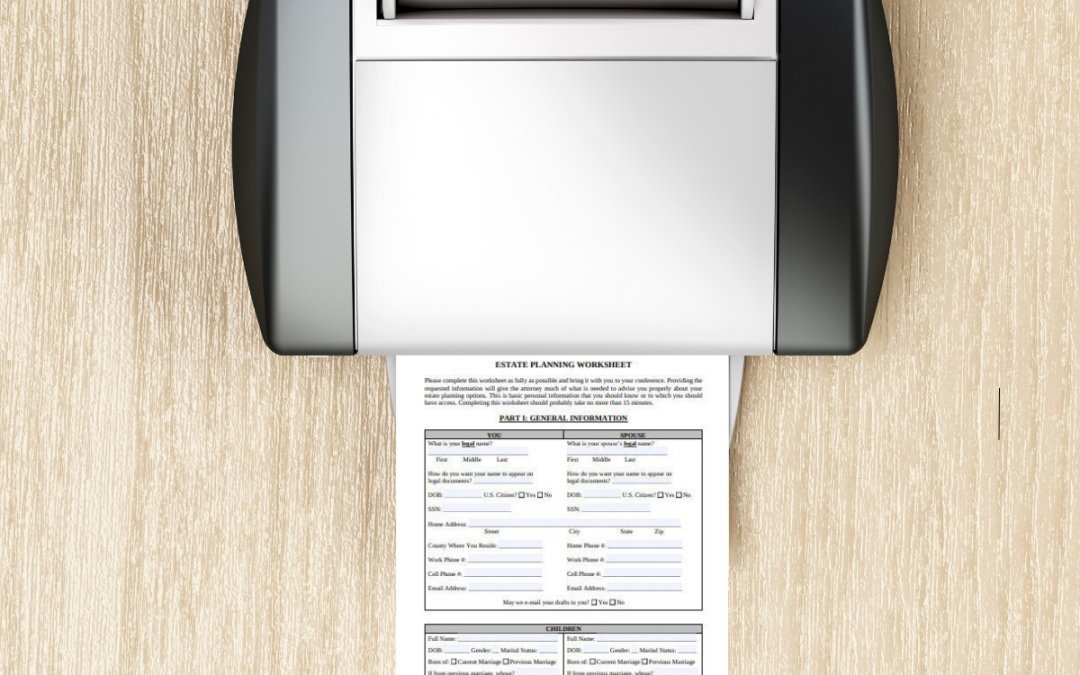

DIY Estate Planning: The Pitfalls of Online Legal Documents

Estate planning is an essential process that involves making decisions about the distribution, and management of your assets and affairs both during your lifetime and after your death. It allows you to determine how and when your assets will be distributed among your...

What to Consider When Creating Your Estate Plan

If you have worked hard and accumulated significant assets, it is likely that you are enthusiastic to make sure that your assets, properties, and affairs are arranged to ensure their effective management during your incapacity or distribution upon your death. You do...

Special Needs Trusts: Supporting Your Child’s Future

Deciding whether you should appoint co-trustees vs a single trustee to manage your trust should be taken seriously, and it is encouraged that you seek the guidance and counsel of an experienced estate planning attorney.