“Do I really need a Will, or would a Trust work better for me?”

It might seem like a simple question, but choosing between a Will and a Trust, even deciding whether you need both, can have lasting impacts on your estate and peace of mind. This is especially important in California, where specific state laws influence how assets are managed and passed on.

Even if you’re just starting out in life, setting up a basic estate plan is a smart move. A well-crafted plan doesn’t just protect your assets, but it is designed to protect you should you become incapacitated. A comprehensive estate plan helps your family avoid the often lengthy and costly probate process, ensuring that your wishes are fulfilled without unnecessary delay or confusion. Further, well thought out plan will help your family should there be a medical event or you become incapable of making decisions for yourself.

Let’s break down the differences between Wills and Living Trusts, highlighting factors like cost, privacy, and how each tool works to keep your assets safe and your family’s future secure.

Understanding the Basics

A solid estate plan starts with knowing the fundamental tools at your disposal: a Will and a Living Trust. While both are designed to ensure your assets are distributed according to your wishes, they operate in distinct ways and serve different purposes.

What is a Will?

A Will is a legal document that outlines how your assets will be distributed after your death. A Will allows you to name beneficiaries, appoint an executor to carry out your instructions. Essentially, a Will sets the stage for your estate’s future, by spelling out what you intend. Think of your Will as an instruction sheet.

Wills only take effect after your death and do not perform any function while you are alive. Here in California, a Will at death typically requires the probate process, a court-supervised procedure that validates the Will and oversees the paying off debts and the distribution of assets. While probate can ensure that your wishes are formally executed, it is a public proceeding and will involve delays and significant extra expenses.

Advantages & Limitations:

- Advantages: Generally straightforward and less expensive to create; easier to update through codicils (amendments).

- Limitations: Typically involves higher upfront costs and more comprehensive ongoing management (e.g., transferring assets into the trust) to ensure that the Trust is fully funded.

What is A Trust?

A Living Trust (also called a revocable trust, family trust) is a separate legal entity where you transfer ownership of your assets e.g., house, bank accounts, life insurance to a Trust during your lifetime. You still maintain complete control over the assets as the trustee, while picking a successor trustee who you trust who will manage the trust after your death or if you become incapacitated. The primary goal is to manage and protect your assets during your lifetime and then bypassing the probate process. This will save the family tens of thousands of dollars and significant time.

Unlike a Will, a Living Trust takes effect immediately once established, allowing you to manage your assets efficiently. Upon your death, the Trust transfers property to your beneficiaries without the need for probate, preserving privacy and often reducing associated legal costs and delays.

Advantages & Limitations:

- Advantages: Helps avoid probate, maintains privacy (since Trust terms aren’t public), and can provide management instructions in case of incapacity.

- Limitations: Typically involves higher upfront costs and more comprehensive ongoing management (e.g., transferring assets into the trust) to ensure that the Trust is fully funded.

California-Specific Considerations

California’s probate process can be complex and time-consuming. Wills must go through probate, which in many cases, may take well over a year to complete, significantly delaying asset distribution and increasing costs ten-fold.

California law imposes certain requirements on estate planning documents.

For example, community property laws affect the distribution of assets between spouses, and state-specific rules govern how property is titled or transferred into a Trust. Being aware of these nuances is crucial, as they can impact the effectiveness of your estate plan.

Whether you choose a Will or a Trust (or a combination of both), considering California’s distinctive legal landscape ensures that your estate plan is both robust and compliant. It’s often wise to work with an experienced estate planning attorney who understands these local factors and can tailor your documents accordingly.

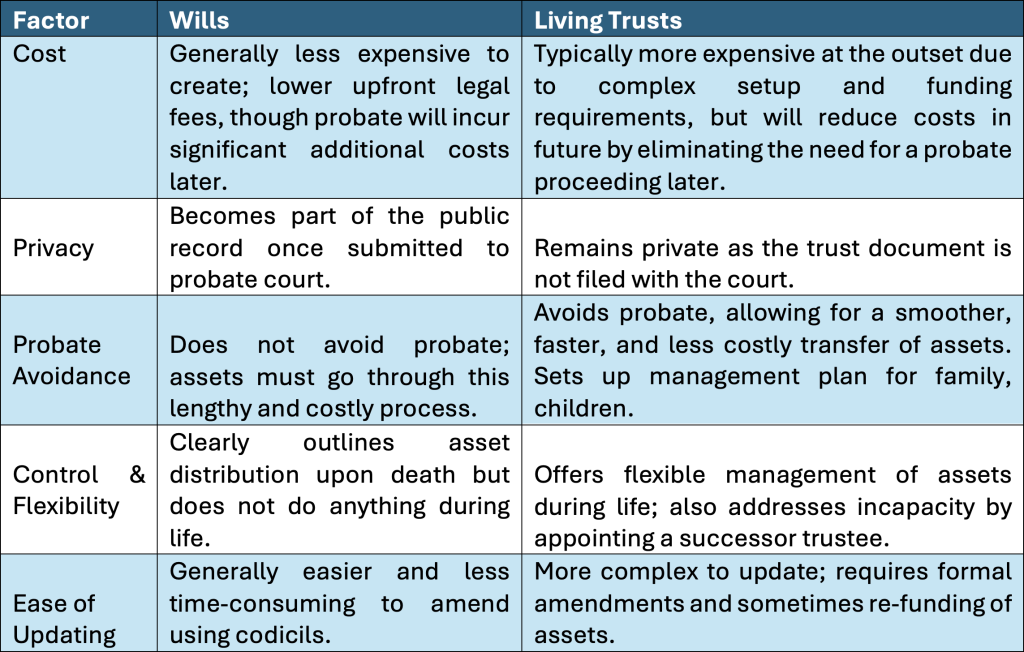

Wills vs. Trusts

Below is a side-by-side comparison that highlights the key differences in areas such as cost, privacy, probate avoidance, flexibility, and ease of updating.

When Might You Need Both?

For many individuals, the decision is not necessarily one or the other, but using a Trust in conjunction with a Will (often called a pour-over will) can provide a comprehensive solution that leverages the strengths of both approaches.

Here’s how and why you might consider using them together:

Complementary Use Cases

- Pour-Over Will: When you establish a Living Trust, a pour-over Will acts as a safety net. It ensures that any assets not titled in the Trust at the time of your death are “poured over” into the Trust by way of the Will. This dual approach helps to guarantee that your Trust remains the centerpiece of your asset distribution strategy.

- Managing Different Types of Assets: While a Living Trust is ideal for managing and protecting major assets (like real estate or significant investments) by avoiding probate, a Will can be a cost-effective option for smaller or miscellaneous assets. Combining both allows you to take advantage of the strengths of each tool.

- Addressing Unique Family Dynamics: A Will can specify guardianship arrangements and clarify personal wishes that a Trust might not cover effectively, such as sentimental items or instructions for minor children. Meanwhile, the Trust handles the more complex financial and property-related aspects.

Practical Scenarios

- For Younger Adults: If you’re just starting out and your estate is relatively simple, a Will might be sufficient initially. However, as your assets grow and life situations become more complex such as purchasing a home or starting a family, transitioning to or adding a Living Trust can help protect your growing estate and avoid probate hassles.

- For Families with Diverse Assets: Families often have a mix of both tangible and intangible assets. Using a Trust to manage high-value or sensitive property (like real estate or business interests) while relying on a Will for personal items and smaller assets can create a balanced, efficient estate plan.

- For Those with Evolving Circumstances: Life is dynamic. Changes like marriage, divorce, the birth of a child, or significant asset growth might necessitate revisions in your estate planning documents. Establishing a plan that incorporates both a Will and a Trust provides the flexibility to make targeted updates as your life circumstances evolve.

Using a Will alongside a Living Trust isn’t about choosing one over the other; it’s about creating a layered defense that addresses all aspects of your estate planning needs. This combined strategy protects you during life and ensures that your wishes are honored in the most efficient and private manner possible.

Ready to take the next step?

As you weigh factors like cost, privacy, probate avoidance, and the flexibility required for your assets, remember that there’s no one-size-fits-all solution.

At DRS Law, we’re here to help you navigate these important decisions. Our team can guide you through assessing your needs, establishing the right combination of estate planning tools, and ensuring your documents meet all California requirements.

Whether you’re just starting your estate plan or looking to update an existing one, a consultation with our experienced attorneys can provide clarity and direction.

Contact us today for a free, no-obligation consultation to discuss how we can help you build a comprehensive estate plan that aligns with your future goals.

Schedule A Consultation | Learn More About Our Services

Protect your legacy. Plan confidently with DRS Law.

Common Questions

How much does it cost to create a will versus a trust in California?

Wills are generally less expensive to create upfront and easier to update. Trusts typically involve higher initial costs and require ongoing management like transferring assets into the trust, but they can save your family tens of thousands of dollars by avoiding probate court fees and delays. In essence, a Will costs more in the long run, since the assets will likely have to go through a probate proceeding. By comparison, a trust is often 1/10th of the cost of a probate proceeding.

What happens if I become incapacitated – does a will or trust protect me better?

A living trust protects you if you become incapacitated because it takes effect immediately and allows your chosen successor trustee to manage your assets. A will only works after death, so it provides no protection if you’re unable to make decisions while still alive.

Do I need both a will and a trust, or should I choose just one?

Many people benefit from having both. A “pour-over will” acts as a safety net to catch any assets not placed in your trust, while the trust handles major assets like real estate. This combination gives you comprehensive coverage and flexibility for different types of assets.

How long does probate take in California, and can I avoid it completely?

California probate often takes well over a year to complete and significantly increases costs. A properly funded living trust allows your assets to transfer to beneficiaries without probate, maintaining privacy and avoiding these delays and expenses.

What makes California estate planning different from other states?

California has specific community property laws affecting married couples, complex probate requirements, and state-specific rules for how property must be titled or transferred into trusts. These local factors require your estate plan to comply with California’s distinctive legal requirements.